new mexico gross receipts tax form

Through Month Day Year Month Day Year T A X P E R I. Laboratory partnership with small business tax credit may be claimed only by national laboratories operating in New Mexico and is applied against gross receipts taxes due up to 1800000.

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Legal liability for New Mexico gross receipts tax is placed on sellers and lessors.

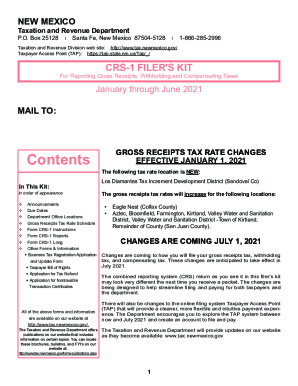

. The folders on this page contain everything from returns and instructions to payment vouchers for both. From your local district office or download the form from our web site at wwwtaxnewmexicogov. Taxation and Revenue New Mexico.

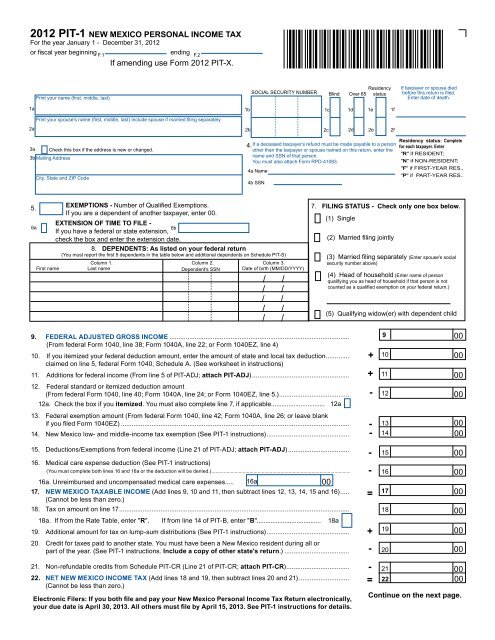

This form is for income earned in tax year 2021 with tax returns due in. The State of New Mexico does not directly impose State sales tax on consumers instead it assesses a gross receipts tax on. Use form GRT-PV to pay any owed taxes towards the New Mexico Gross Receipts Tax.

July 7 2021. Welcome to the Taxation and Revenue Departments Forms Publications page. Because the New Mexico Legislature removed the expiration date for paper NTTCs in the 1992 Series all executed.

Download or print the 2021 New Mexico Form RPD-41071 APPLICATION FOR REFUND for FREE from the New Mexico Taxation and Revenue Department. Gross Receipts Tax Correspondence Taxation and Revenue Department PO. After registering the business will be.

BOX 25128 Santa Fe NM 87504-5128. Forms Publications. Consumables Gross Receipts Tax Deduction for Manufacturers.

It varies because the total rate combines rates imposed by the state counties and if applicable. We last updated the Gross Receipts Tax Payment Voucher in July 2022 so this is the latest version of Form GRT-PV fully updated for tax year 2021. As a seller or lessor you may charge the gross receipts tax amount to your customer.

We last updated the Gross Receipts Tax Payment Voucher in July 2022 so this is the latest version of Form GRT-PV fully updated for tax year 2021. Francis Drive Santa Fe NM. Montoya Building 1100 S.

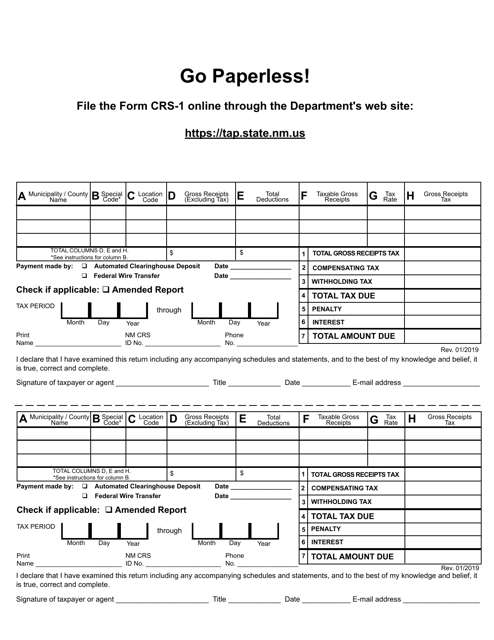

The Taxation and Revenue Department encourages all taxpayers to file electronically. State of New Mexico - Taxation and Revenue Department. This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return.

Filing online is fast efficient easy and user friendly. It varies because the total rate combines rates. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

Report the regular gross receipts tax the leased vehicle gross receipts tax and the leased vehicle. Taxation and Revenue New Mexico. Filing your Gross Receipts Tax GRT online takes the stress out of work so you have time for more enjoyable things.

TOTAL GROSS RECEIPTS 1 TAX ALL PAGES 2 3 5 6 4 7. A 2-per-day leased vehicle surcharge is also imposed on certain vehicle leases. You can also deliver NTTCs in paper form to your vendors.

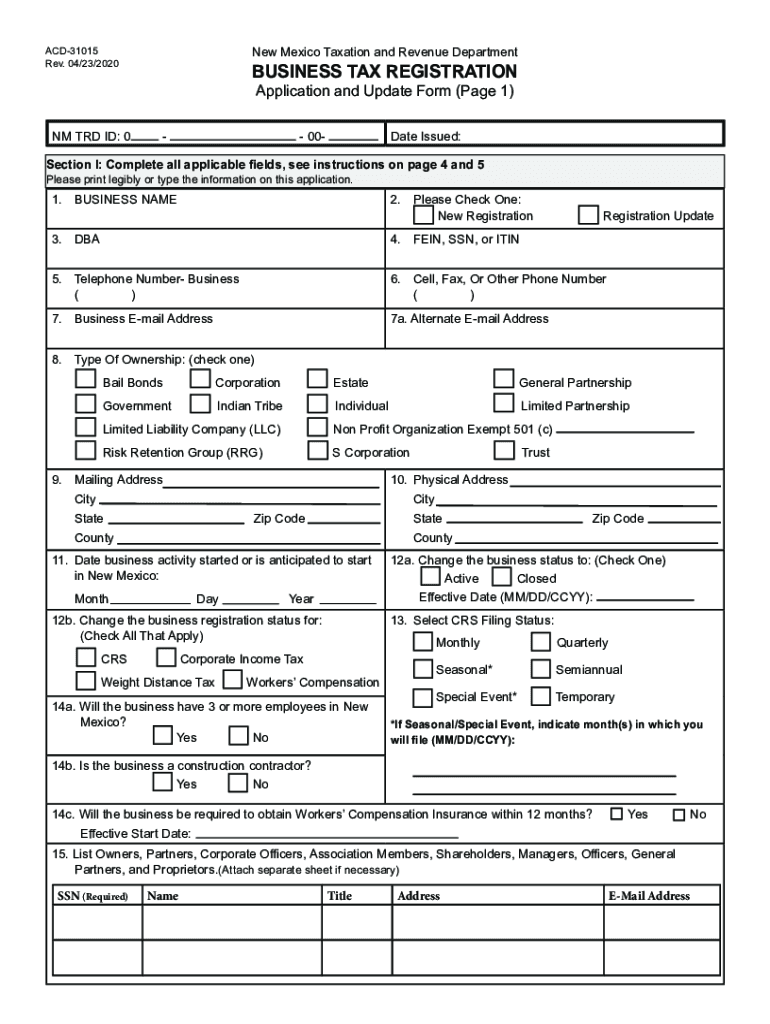

A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting the paper form ACD-31015. Each Form TRD-41413 is due on or before the 25th of the month following the end of the tax period being reported. 222012 New Mexico Taxation and Revenue Department Advanced Energy Gross Receipts.

Taxation and Revenue Department adds more fairness to New Mexicos tax system expediting the innocent spouse tax relief application process. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. Earlier today the Taxation and Revenue Department updated a key publication providing guidance on Gross Receipts Taxes GRT with new information on.

Use form GRT-PV to pay any owed taxes towards the New Mexico Gross Receipts Tax. Taxpayer Access Point TAP TAP is the Departments electronic filing system. Advanced Energy Gross Receipts Tax Deduction Report Form RPD-41349 RPD-41349 Rev.

P Additional Information or Instructions. We urge you to. New Mexico Economic Development Department Joseph M.

We last updated New Mexico Form GRT-PV in July 2022 from the New Mexico Taxation and Revenue Department. Hearing scheduled April 29 on new Gross Receipts Tax regulations. GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return.

New Mexico Llc How To Start An Llc In New Mexico Truic

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Short Form For 3 Or Fewer Business New Mexico Templateroller

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Crs 1 Form Fill Out And Sign Printable Pdf Template Signnow

Form Rpd 41323 Fillable Gross Receipts Tax Credit For Certain Unpaid Doctor Services

Nm Lodgers Tax Report 2020 2022 Fill Out Tax Template Online Us Legal Forms

Pit 1 New Mexico Personal Income Tax Return Taxation And

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico Taxation Revenue Youtube

How To File And Pay Sales Tax In New Mexico Taxvalet

Form Rpd 41071 Fillable Application For Refund

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Gross Receipts And Property Tax Ppt Download

New Mexico Clarifies Gross Receipts Tax On Food Avalara

Nttc Type 5 Fill Online Printable Fillable Blank Pdffiller

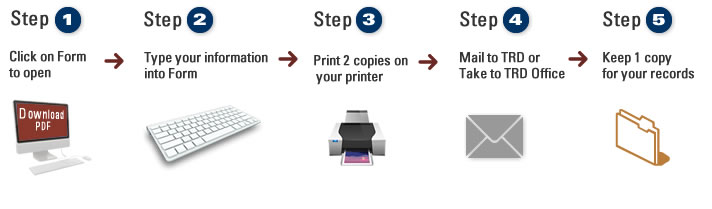

Fill Print Go Taxation And Revenue New Mexico

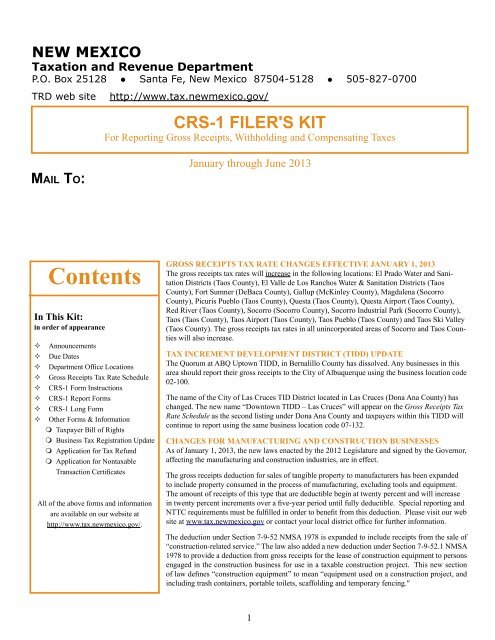

Filers Kit Taxation And Revenue Department State Of New Mexico